BTC Price Prediction: 2025-2040 Forecast Analysis and Market Outlook

#BTC

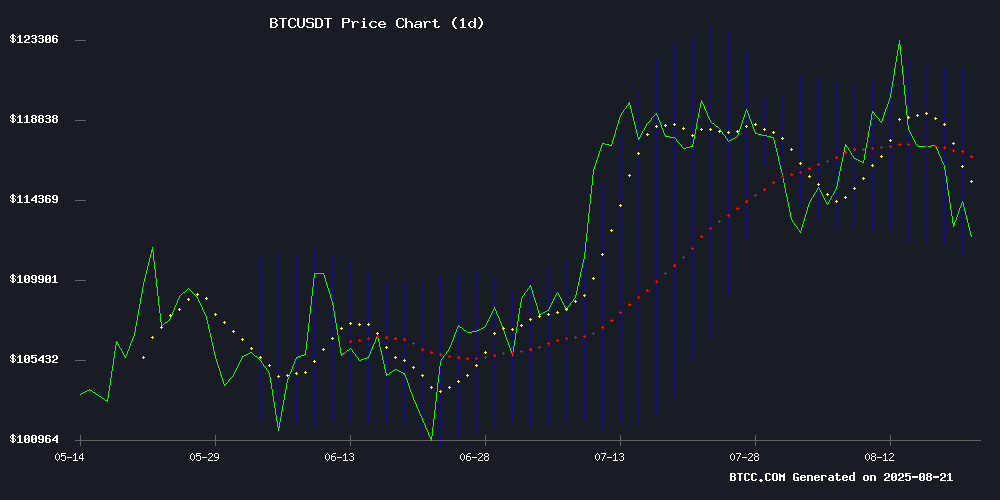

- Technical indicators show short-term bearish pressure with BTC trading below 20-day MA at $116,495

- Market sentiment reflects mixed signals with retail weakness but strong institutional long-term optimism

- Long-term price predictions remain bullish with potential for $1M+ by 2030 based on adoption trends

BTC Price Prediction

Technical Analysis: BTC Shows Bearish Signals Below Key Moving Average

BTC is currently trading at $113,161, below its 20-day moving average of $116,495, indicating short-term bearish pressure. The MACD reading of -524.6 remains in negative territory, suggesting continued downward momentum. However, BTC is trading NEAR the lower Bollinger Band at $111,226, which could provide potential support. According to BTCC financial analyst Mia, 'The technical indicators point to consolidation in the near term, with the $111,200 level acting as critical support. A break below this could trigger further selling pressure.'

Market Sentiment: Mixed Signals Amid Volatility and Institutional Interest

Current market sentiment reflects a combination of short-term caution and long-term optimism. News of Bitcoin retreating 9% from August peaks and short-term holder capitulation indicates near-term pressure. However, institutional perspectives remain bullish, with Coinbase CEO Brian Armstrong predicting $1M BTC by 2030. BTCC financial analyst Mia notes, 'While retail sentiment has weakened temporarily, the underlying institutional narrative and long-term predictions suggest this dip may present accumulation opportunities for patient investors.' The debate around Bitcoin's 4-year cycle and its challenge to traditional finance continues to drive fundamental interest.

Factors Influencing BTC's Price

Binance Dominates Crypto Trading Volume Amid Market Contraction

Binance has solidified its position as the undisputed leader in cryptocurrency trading, with its 2025 volume eclipsing the combined activity of its top five competitors. The exchange processed $8.39 trillion in Q1 trades—36.5% of global volume—while rivals like Bybit ($7.9B daily), OKX ($6.5B), and Coinbase ($5.6B) trailed far behind.

Market concentration reached unprecedented levels by midyear, with Binance capturing 42% of spot trading. Its $1.9 trillion spot volume exceeded the aggregate of Coinbase, Crypto.com, and OKX—a dominance last seen during Bitcoin's 2024 rally above $70,000.

Bitcoin Traders Brace for Volatility as BTC Faces Key Support Test

Bitcoin's rally to a record $124,700 in August has given way to mounting pressure, with the cryptocurrency now testing critical support levels. The failure to hold gains above $110,000 threatens to trigger cascading liquidations that could accelerate declines toward $100,000.

Market structure remains nominally bullish, with the April uptrend still intact. But the swift rejection from all-time highs and subsequent lower highs paint a concerning technical picture. Analysts are closely monitoring spot Bitcoin ETF flows for signs of institutional conviction.

The coming sessions will prove decisive. Either buyers defend the psychological $110,000 level to prevent a deeper correction, or bears gain control and force a retest of the $100,000 support zone. Market participants await clarity on whether recent ETF outflows represent temporary profit-taking or a more sustained withdrawal of institutional interest.

Wall Street Economists Grapple with Bitcoin's Decentralized Nature as Crypto Challenges Traditional Finance

Wall Street economists find themselves perplexed by Bitcoin and cryptocurrencies, labeling them as non-textbook puzzles. Accustomed to centralized systems where banks and governments dictate terms, these traditionalists struggle to comprehend an asset class that operates without intermediaries. Bitcoin's decentralized framework, powered by blockchain technology, eliminates the need for trusted third parties—a radical departure from the fiat systems economists are trained to analyze.

The inherent scarcity of Bitcoin stands in stark contrast to inflationary monetary policies, positioning it as a hedge against central bank overreach. While economists view the lack of oversight as a flaw, crypto proponents argue it's the very feature that ensures transparency and resistance to manipulation. Every transaction is verified by a global network of miners, not a single authority, reducing costs and accelerating cross-border payments.

What Wall Street dismisses as confusion may instead represent a paradigm shift. As one economist noted a decade ago, Bitcoin's defiance of conventional wisdom isn't a bug—it's the point. The market seems to agree, with Bitcoin's $2.26 trillion market cap reflecting growing institutional acceptance despite traditional skepticism.

Short-Term Bitcoin Holders Capitulate Amid Sharp Price Drop

Bitcoin's rapid descent from record highs above $124,000 to below $115,000 has triggered one of the most significant liquidation events in weeks. Short-term investors moved over 50,000 BTC—worth approximately $5.69 billion—to exchanges at a loss within a 48-hour window, according to CryptoQuant data.

The $110,000 level now emerges as a critical technical threshold. Market analysts are divided on whether this represents a healthy correction or the start of a prolonged bearish phase. The scale of realized losses suggests a notable shift in trader psychology, with bullish conviction being tested.

Exchange flows indicate panic selling among newer market participants. This capitulation event mirrors past cycle patterns where weak hands exit before institutional buyers establish new support levels. The coming weeks will determine if this is merely profit-taking or a more fundamental sentiment reversal.

Top Crypto Presales for Massive ROI Potential Feature Bitcoin Swift and Light Chain AI

Investor attention is converging on two standout presales this August: Light Chain AI (LCAI) and Bitcoin Swift (BTC3). Light Chain AI has raised over $17 million, touting ambitious but speculative innovations like its Proof of Intelligence consensus and AI Virtual Machine. However, its late 2025 launch timeline tests investor patience.

Bitcoin Swift, by contrast, is accelerating momentum with an early August 30 launch. Its immediate rewards model and strong community backing contrast sharply with projects demanding deferred gratification. The presale market’s appetite for high-potential early-stage projects remains voracious, though execution risks loom large for unproven protocols.

Coinbase CEO Brian Armstrong Predicts Bitcoin Price Could Hit $1M by 2030

Coinbase CEO Brian Armstrong has broken his usual silence on price predictions with a striking forecast: Bitcoin could reach $1 million by 2030. The statement, made during an interview promotion on X, aligns with bullish projections from industry heavyweights like Jack Dorsey and Cathie Wood.

Regulatory tailwinds in the U.S. are fueling optimism. Stablecoin legislation and market structure reforms progressing through Congress could create a watershed moment for crypto adoption this year. Armstrong highlighted the symbolic significance of the U.S. government's growing Bitcoin reserves as an unexpected accelerant.

The $1 million thesis gains credence from institutional adoption metrics. Michael Saylor's analysis suggests mainstream finance allocating mere single-digit percentages to Bitcoin could propel it to seven figures. Fiat currency debasement and global debt concerns, as noted by Robert Kiyosaki, add fundamental weight to these technical projections.

Bitcoin Retreats 9% From August Peak Amid Weakening Retail Sentiment

Bitcoin's price slid to $113,700, marking an 8.5% decline from its August high of $124,500. The drop reflects eroding retail confidence despite sustained institutional interest. Market capitalization contracted to $3.8 trillion, dragging altcoins lower in its wake.

Derivatives markets flashed warning signs as futures volume rose 6% to $83.7 billion while open interest dipped 1%. This divergence suggests traders are unwinding positions rather than establishing new ones—a classic risk-off signal during periods of elevated volatility.

The Fear & Greed Index plummeted 12 points to 44, firmly planting market psychology in 'Fear' territory. Analysts note the pullback follows Bitcoin's overheated rally earlier this month, with whale accumulation providing a floor to the correction.

Glassnode Revives Debate: Is Bitcoin’s 4-Year Cycle Still Alive?

Glassnode's latest analysis challenges the notion that Bitcoin's four-year cycle has been erased by institutional adoption. The on-chain data firm identifies profit-taking patterns among long-term holders that mirror historical euphoric phases, suggesting the cycle remains intact.

Bitcoin's recent price action aligns with cyclical models, despite an 8.3% pullback from its August 14 all-time high of $124,128. The cryptocurrency currently trades around $113,940, showing short-term fatigue while maintaining its broader bullish trajectory.

Historical models point to a potential cycle peak as early as October 2025. This timing would place the next halving event squarely within Bitcoin's established rhythm, even as institutional players reshape market dynamics.

Bitcoin Price Prediction: Will BTC Reach $200K in 2025?

Bitcoin, the world's leading cryptocurrency, is trading near $113,000 as investors speculate whether it could hit $200,000 by 2025. Anthony Scaramucci, founder of SkyBridge Capital, argues that institutional adoption—not retail speculation—is driving this rally. Pension funds, global banks, and traditional finance giants are quietly accumulating BTC, marking a shift from past bull cycles fueled by retail mania.

The supply-demand imbalance is tightening. With only 450 new bitcoins mined daily post-halving and demand surging, scarcity is becoming a critical price catalyst. Bitcoin's fixed supply of 21 million coins contrasts sharply with fiat currencies, creating a structural bullish case.

BTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical analysis and market sentiment, here are projected price forecasts for BTC:

| Year | Conservative Forecast | Moderate Forecast | Bullish Forecast | Key Drivers |

|---|---|---|---|---|

| 2025 | $140,000-$160,000 | $180,000-$220,000 | $250,000+ | ETF adoption, halving effects |

| 2030 | $300,000-$400,000 | $500,000-$700,000 | $800,000-$1M | Institutional adoption, regulatory clarity |

| 2035 | $600,000-$800,000 | $1M-$1.5M | $2M+ | Global reserve asset status |

| 2040 | $1.5M-$2M | $2.5M-$4M | $5M+ | Full digital gold narrative realization |

BTCC financial analyst Mia emphasizes that these projections assume continued adoption growth and favorable regulatory developments, noting that 'Bitcoin's long-term trajectory remains fundamentally strong despite short-term volatility.'